Digital Marketing in Indian Pharma: MNC vs Domestic Adoption Trends (2025 Study)

- 0 Comments

- 10 Views

New 2025 study of 199 pharma pros reveals MNCs lead in AI, SEO & omnichannel HCP engagement. Domestic firms lag but can catch up via CRM & upskilling.

199-Respondent Study Maps India's Pharma Digital Divide

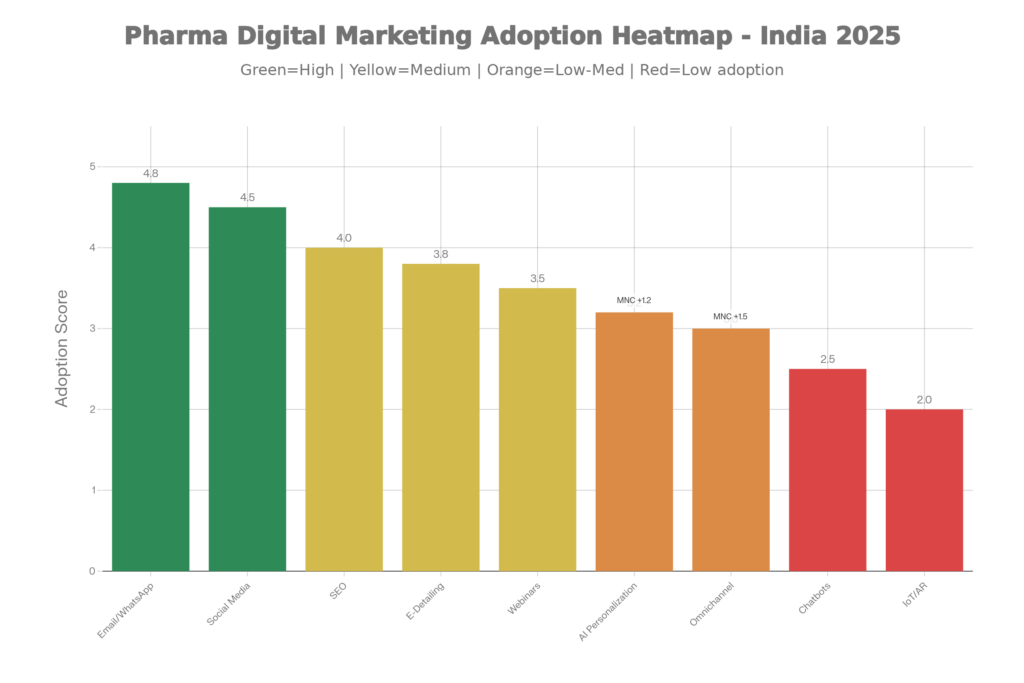

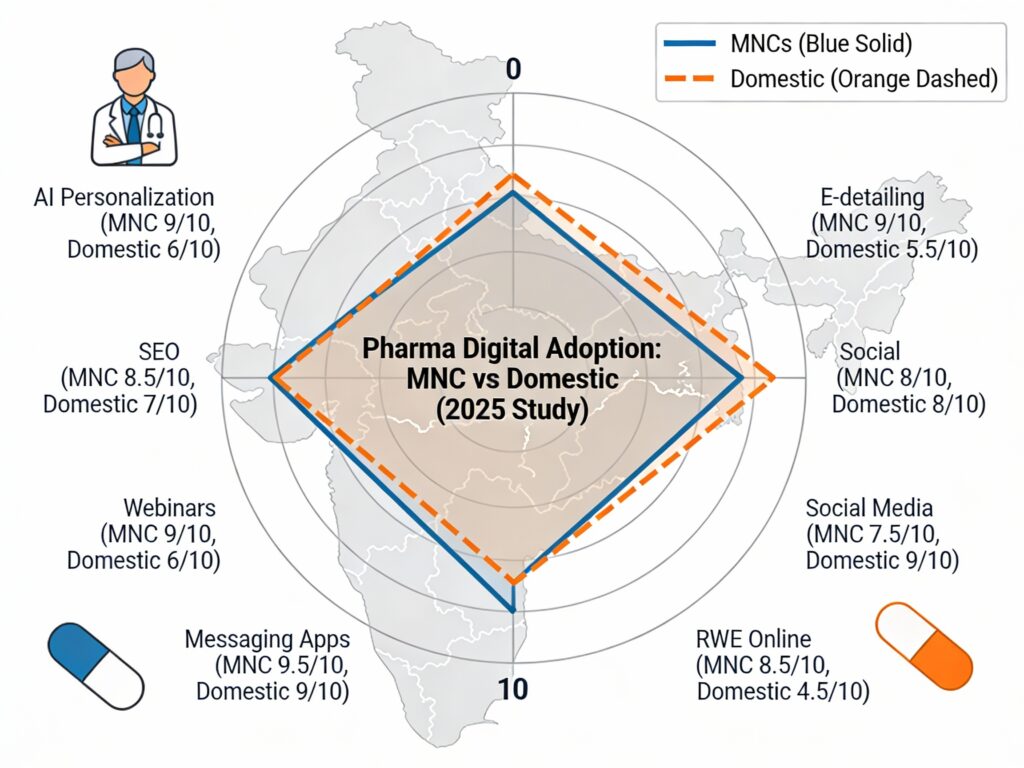

This article examines how Indian pharmaceutical companies are adopting digital marketing, comparing domestic firms and multinationals (MNCs) using survey data from 199 marketing professionals and thematic analysis of open responses. Fifteen digital tactics were assessed, from basic email and WhatsApp outreach to advanced approaches such as AI‑based personalization, SEO, e‑detailing, omnichannel campaigns and real‑world evidence generation.

“Digital marketing is no longer a bolt‑on in Indian pharma—it is the backbone of how brands reach and retain healthcare professionals."

MNCs Dominate Advanced Tools with Superior Infrastructure

MNCs and top‑50 Indian Pharmaceutical Market (IPM) players showed significantly higher adoption of sophisticated tools (AI, predictive analytics, omnichannel, online RWE, advanced SEO), supported by better infrastructure, larger budgets and global playbooks.

Domestic Firms Rely on WhatsApp, Social Despite Analytics Gaps

Domestic and lower‑ranked firms relied more on low‑cost channels (messaging apps, basic social media, simple email campaigns) and often lacked analytics depth or structured execution models.

6M, 5D Frameworks Decode Organisational Digital Readiness

Frameworks such as 6M (Market, Mission, Message, Media, Money, Measurement), 5D (Devices, Platforms, Media, Data, Technology), Diffusion of Innovations and Organizational Information Processing Theory were used to interpret adoption patterns and organisational readiness.

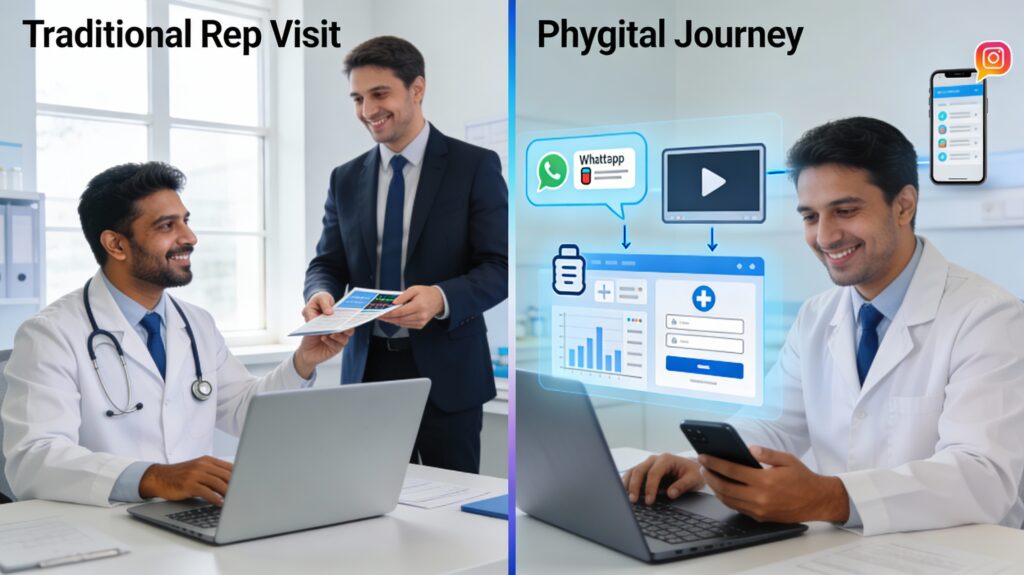

Phygital, GenAI, Chatbots Emerge as Pharma's Next Frontiers

Emerging themes included “phygital” engagement (blending in‑person and digital HCP touchpoints), generative AI content, chatbots, IoT‑enabled apps, and eye‑tracking for creative optimisation.

Maturity Over Tools: CRM + Upskilling = Domestic Firms' Path Forward

The study concludes that digital marketing is now essential for HCP engagement in India but success depends on organisational maturity—strategy alignment, data and tech infrastructure, talent, and strong governance around ethics and regulatory compliance (especially data privacy). Smaller and domestic firms can close the gap via focused investments in scalable CRM, analytics and upskilling rather than tool‑centric, fragmented experiments.

“The real differentiator is not whether companies use WhatsApp or webinars, but whether they connect data, content and channels into a coherent omnichannel experience.”

“clinical” points for pharma marketers

- Digital is mainstream: email, WhatsApp and social media are the most widely used tactics; webinars and online events are less mature but growing.

- MNCs and top‑50 firms lead in AI‑driven personalization, SEO, e‑detailing, omnichannel orchestration and online real‑world evidence generation.

- Domestic and beyond‑top‑50 firms depend on low‑cost channels and often lack robust CRM/analytics, limiting personalization and measurement.

- Organisational maturity (leadership, processes, data systems) is the main differentiator in digital readiness, more than company type alone.

- Emerging “phygital” models, generative AI, chatbots and IoT are promising but require strong ethical and regulatory governance.

Key Finding

| Area | Finding | Implication for practice |

|---|---|---|

| Adoption level | 15 digital strategies assessed across 199 professionals; email & messaging most used. | Prioritise structured planning even for “basic” channels to avoid noisy, unmeasured use. |

| MNC vs Indian firms | MNCs show higher use of AI, omnichannel, SEO, e‑detailing, online RWE. | Domestic firms should selectively adopt high‑impact tools rather than copy full stacks. |

| Top‑50 vs beyond‑50 | Top‑50 IPM companies invest more in advanced, data‑heavy tactics. | Smaller firms can focus on scalable CRM, segmentation and simple automation first. |

| Emerging innovations | Phygital engagement, generative AI, chatbots, IoT, eye‑tracking highlighted by respondents. | Pilot carefully with clear KPIs and compliance guardrails. |

| Organisational maturity | Digital performance tracks with strategy, infrastructure and skills, not just tool choice. | Build cross‑functional digital governance and continuous upskilling. |

Why Every Indian Pharma Brand Needs a Compliant Website in 2026

85% of Indian Doctors now research treatments online before meeting reps, making websites the #1 discovery channel.

Pharma websites are no longer optional—they’re mandatory hubs for ethical digital engagement amid tightening UCPMP regulations and HCP digital expectations.

SEO and HCP Discovery

85% of Indian doctors research drugs online before reps visit. Compliant sites rank for “treatment guidelines” or “generics India,” capturing high-intent traffic and positioning brands as thought leaders.

Regulatory Compliance Shield

With UCPMP 2024 now facing Supreme Court push for statutory enforcement (November 2025 ruling), websites must showcase disclaimers, privacy policies, and transparent content to prove ethical practices. DoP mandates disclosures and ethics committees—your site becomes audit-ready proof.

Omnichannel Engagement Base

Integrate doctor portals, CME resources, webinars, and chat for seamless HCP journeys. Post-2025 studies show MNCs using sites for AI-personalized e-detailing outperform others by 50% in engagement.

Trust and Credibility Builder

Professional designs with product info, RWE downloads, and contact forms build credibility vs. social-only presence. Regulators and partners check sites first—non-compliant ones risk blacklisting.

Measurable ROI Driver

Track visits, downloads, and leads via analytics. In 2026’s digital-first pharma, sites support omnichannel ROI, converting 3x better than print alone amid rising digital HCP spend.

Prioritise UCPMP-compliant builds (no direct claims, clear disclaimers) to future-proof against CDSCO scrutiny and Supreme Court demands for stronger consumer remedies.

Leave feedback about this