Maximizing ROI: Analyzing the True Effectiveness of Marketing Expenses in Driving Sales

- 1 Comment

- 26 Views

Businesses pour billions into marketing each year. Yet, many pharma leaders scratch their heads over one big question: does that spend truly boost sales? It’s easy to get lost in shiny stats like website visits or social likes, but those often hide the real story. The true test comes down to linking every dollar spent to actual revenue.

In India’s pharmaceutical industry, marketing is no longer a “nice to have”—it is a strategic lever that can make or break sales performance in an intensely competitive, innovation‑driven market. From physician engagement and CME sponsorships to digital campaigns and hospital‑level negotiations, companies routinely invest crores every year to protect market share and launch new molecules. Yet leadership teams still grapple with a basic question: how much of that marketing expense really converts into incremental sales, and how much is just noise?

A recent empirical study published in the EPRA International Journal of Multidisciplinary Research analysed ten leading public pharmaceutical companies in India between 2019 and 2024 to answer exactly this question. Using descriptive statistics, correlation analysis and firm‑level regression models, the authors evaluated whether higher marketing expenditure genuinely translates into higher revenues. The results are nuanced: while most companies show a statistically significant positive link between marketing spend and sales, the strength of that relationship varies sharply by firm, and pooled data suggest that marketing is only one piece of a larger performance puzzle. For pharma leaders, investors and brand teams, these findings argue for smarter, not just bigger, marketing budgets.

What the Study Found About Marketing Effectiveness

“In a sector where detailing, CME sponsorships and digital engagement can easily consume one‑third of SG&A, this study shows that the question is no longer ‘should we spend’ but ‘where and how should we spend to actually move the sales needle.’”

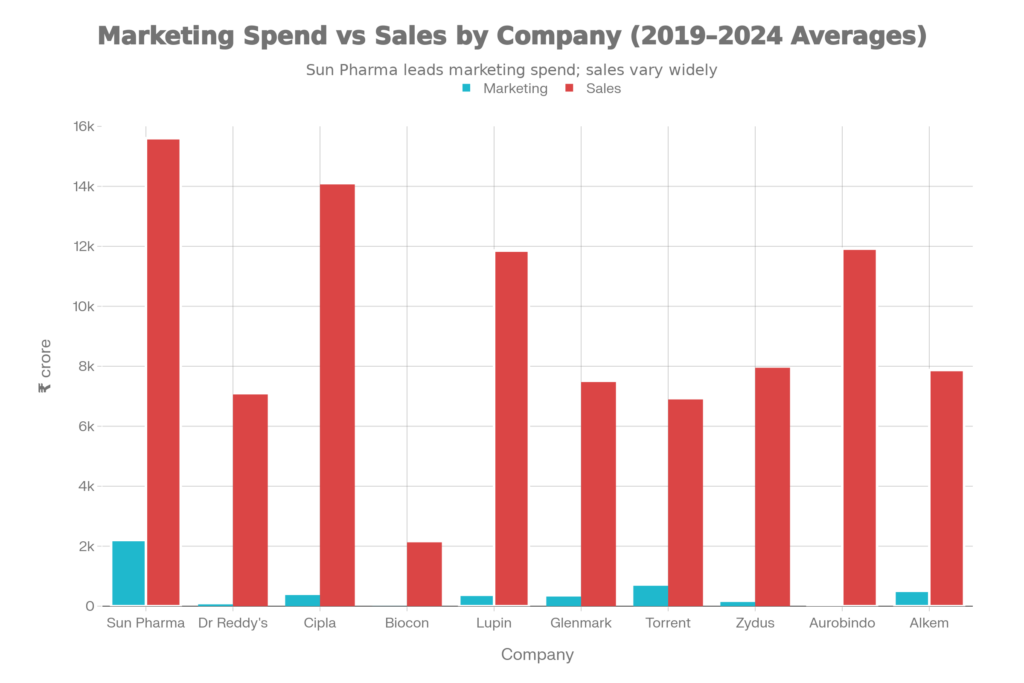

The study examined annual marketing expenditure and sales figures for ten major listed pharma players, including Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, Cipla, Lupin, Biocon, Glenmark, Torrent, Zydus, Aurobindo and Alkem, using data drawn from published annual reports and financial statements. Marketing expenditure was taken mainly from selling, general and administrative (SG&A) lines, while net sales/revenue formed the dependent variable. Over 2019–2024, the descriptive statistics alone reveal a huge spread in both marketing outlay and topline performance: Sun Pharma recorded the highest average marketing spend at about ₹2,205 crore and average sales of roughly ₹15,604 crore, while Biocon’s average marketing spend was only around ₹2.73 crore with far lower but respectable sales, and Aurobindo reported relatively modest marketing expenses but strong revenues, hinting at higher efficiency.

“The weaker pooled relationship between marketing expenditure and revenue is a reminder to boards and investors that topline performance reflects a portfolio of drivers: product mix, pricing, market access, regulatory events and competitive intensity, not just promotional budgets.”

Key Highlights

- Across ten Indian pharmaceutical companies (2019–2024), most firm‑level regressions show a statistically significant positive link between marketing expenditure and sales, with R² values often above 0.94.

- Pooled analysis across all firms reveals a weaker association, confirming that marketing is not the sole driver of revenue and that its effectiveness is highly context‑dependent.

- High‑spend players like Sun Pharma and Lupin pair substantial marketing budgets with strong sales, while companies such as Aurobindo achieve strong revenues with relatively low marketing outlay, suggesting differences in efficiency, portfolio leverage and execution quality.

Conclusion

The evidence from India’s listed pharmaceutical companies reinforces a nuanced but actionable message: marketing expenses can be highly effective in driving sales, but only when deployed strategically and evaluated at a granular level. Firm‑level models explaining up to 95% or more of sales variation through marketing spend highlight the potential power of promotion when it is closely aligned to brand objectives, lifecycle stage and competitive realities. At the same time, the weaker relationship observed in pooled data, along with examples of firms achieving strong revenues with modest budgets, underscores that marketing is just one among many determinants of performance, alongside R&D productivity, pricing, supply reliability, market access and portfolio choices.

For commercial leaders, the path forward is not to reflexively increase budgets, but to measure and manage marketing effectiveness with the same rigour applied to capital expenditure. That means building dashboards that track elasticity of sales to spend by channel and brand, experimenting with digital and data‑driven approaches, and working closely with finance to link campaigns to incremental volume rather than vanity metrics. Investors, meanwhile, should look beyond headline advertising ratios to ask how well each rupee is being translated into durable market share and physician preference. In a tightening regulatory and pricing environment, the winners will be organisations that treat marketing not as a cost centre, but as an investable asset backed by solid evidence of its ability to drive sustainable sales growth.

-

- by: 188bet88betbongda

- 2 months ago

188bet88betbongda, the name’s a mouthful, but I see they focus on football betting. If you’re into betting on the beautiful game, maybe give 188bet88betbongda a looksee.

Leave feedback about this